Will Apple Split Their Stock Again

Shares in Apple Inc. (NASDAQ:AAPL) soared of late, and many believe the stock will continue to climb. In plow, this has led to some churr concerning the prospects of another stock dissever.

Is there a adventure that direction volition initiate a split in the nigh future?

If not, when tin investors expect a split? What sort of functioning can we expect following a carve up? Does the stock exhibit a price surge prior to a separate?

Of class, Apple shares take been on a tear for some fourth dimension. An investor that bought AAPL ten years ago garnered a 962% return, excluding dividends. During the same fourth dimension frame, the S&P 500 less than doubled.

Apple Stock Split History / Seeking Clues

Apple's stock split on 5 occasions.

Share price Prior year gains

06/xvi/1987 2 for 1 $40.50 84.09%

06/21/2000 2 for one $102.81 151.15%

02/28/2005 two for 1 $64.xl 201.36%

06/19/2014 7 for 1 $561.12 5.42%

08/31/2020 four for 1 $293.65 80.75%

(per share cost is for the first of each calendar year)

The information to a higher place indicates there is no particular time frame, nor is there necessarily a stock price threshold, that triggers a stock split. Direction waited as long every bit 13 years between splits and initiated splits with less than a five-year interval.

Even adjusted for aggrandizement, in that location doesn't appear to be a cost that triggers a stock split, peculiarly when one considers the final two occasions when the shares divide.

Apparently, a surge in the stock precipitates stock splits. While there was a relatively depression increase in share value in 2014, that followed four consecutive years of gains that ranged from 147% to over 25% per annum.

What Was The Price Of Apple Stock When It Split And When Might It Dissever Again

Although the nautical chart above provides a share price of $293.65, that was the cost of the stock on the offset trading mean solar day of the year. However, when the company announced the split (in July 2020), the stock was trading around $400 per share. A month later the shares split, and AAPL was trading at $645.57 per share.

One tin assume the decision was made at a lower share valuation. However, every bit AAPL currently trades around $135 per share, I find it a chip premature that some believe another split is imminent.

Considering Apple tree'south history, I believe the most probable scenario is when the shares merchandise virtually $300. However, we should consider this quote from Jim Cramer during an interview in which he discussed the most contempo Apple stock separate.

Tim told me last dark, "Hey, I want more people in the stock."

If the CEO desires that the shares merchandise at a lower valuation, he volition decide the time and price.

Should You Buy Apple Before Or Later on A Split?

Fortunately, we have fairly solid data regarding the trajectory of Apple's shares following a split up.

We must remember that cost activeness in private equities does not occur in a vacuum. For case, CFRA analyst Sam Stovall noted AAPL stock surged 36% the year after the 2014 split but roughshod 60% post-obit the 2000 split and the bursting of the tech bubble.

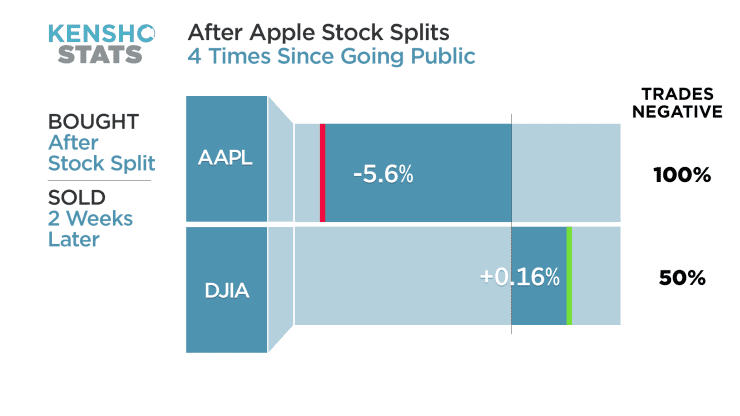

I reviewed cost activity for the 30 days leading up to prior splits, and there is no show Apple stock increased significantly earlier a separate date; however, in the two weeks post-obit a dissever, shares lost an boilerplate of v.6%.

Source: CNBC

That data does non include the 2020 carve up, but like the dot.com bust, stock action in 2020 was an anomaly. Consequently, I'm not sure including the last split would serve to increase our understanding.

Apple tree Provides A Potent Argument For Purchase And Hold Investors

I'1000 taking a detour here to use Apple'south stock split history equally an argument for a buy and concord investment strategy.

Let u.s.a. assume you (or i of your grandparents) invested in 100 shares of Apple tree on the first trading day of 1986. That would result in $2200 ($5236 adjusted for inflation) devoted to a company that would feel a variety of ups and downs over more than three decades.

In fact, there would exist 11 years in that time bridge in which the company would suffer a share price loss. In 1993, 1995, 1996, 1997, 2000, 2002, and 2008, the losses were double digit. 2000 ranked as the worst year, with a drop of over 70%!

And then how would that investor have fared? What would those 100 shares be worth today?

The splits would have multiplied the stock. That investor would own 22,400 shares worth $three,032,288. The annual dividends provide an income stream of $18,368 per year.

I debate that portfolios synthetic with a big number of dominant, well managed companies with strong financial foundations create robust returns over extended time periods.

Recent Developments, Pros And Cons

In my January article, "Apple Or Microsoft Stock: The Ameliorate Investment" I provided an overview of Apple. All the same, in that location have been a number of developments since that article debuted.

Apple's latest quarterly report was full of good news. Revenue set a new record at $111 billion and increased 21% YoY. EPS too set up a new standard and grew 35%.

Mac sales increased 21% while iPad sales were 41% higher YoY. Revenue from home, accessories and wearables jumped thirty%, and service revenues climbed 24%.

Acquirement from sales in Greater Mainland china surged 57%.

With those results in mind, it isn't surprising that Apple tree also generated tape cash flow of $38.viii billion.

"We grew potent double digits in each of our production categories, with all-time records for iPhone, Wearables, Home and Accessories and services as well as a Dec quarter record for Mac. We also achieved double-digit growth and new all-fourth dimension records in each of our five geographic segments and in the vast majority of countries that we track." - Luca Maestri, CFO.

Just equally the visitor broke records in other areas, information technology also set a new marker in iPhone sales. At $65.6 billion for the quarter, that represents close to 60% of the company'southward revenue. The final figure is welcomed in that there are concerns iPhone sales may take reached a near saturation indicate.

In that location is at least 1 observer that would rebut any fear of iPhone sales slowing.

Wedbush analyst Daniel Ives believes xx% of iPhone upgrades will originate in Mainland china. He estimates that 350 million of the 950 1000000 iPhones across the globe are in an upgrade cycle. Wedbush'south review of Asian supply chains indicates sales of the iPhone could hit 240 to 250 million.

Apple tree'due south move to lesser priced iPhones, the 12 mini model starts at $699, undoubtedly aids the company in its efforts. Along with the iPhone 12 at $799, Apple competes well with Samsung's S21 at $799+ and the S21+ at $999.

Even so, amongst all of the expert news, there is an arena in which Apple may be losing. Apple TV+ may be a rotten apple.

Co-ordinate to a survey by MoffettNathanson, 62% of customers of that streaming service are still on a free trial. Furthermore, 29% of those surveyed have no intention of continuing with the service once their costless ride ends. But xxx% said they plan to renew their subscription. Considering the service is priced at $four.99 a month, I have to inquire, "Just how bad is this Apple Goggle box+?"

To put the numbers for Apple Goggle box+ into perspective, 48% of Disney+ viewers accessing the gratis Verizon streaming service intend to subscribe once the costless trial ends.

Apple's solution is to add an boosted nine months to the trial period.

I've reported extensively on a variety of streaming services. With the large number of players competing for subs, I must wonder if there will eventually be some casualties.

Reports surfaced in 2019 that the company was spending $6 billion per yr on new content lonely. I fully understand that Apple is greenbacks rich, but $half-dozen billion here and $vi billion there add upward.

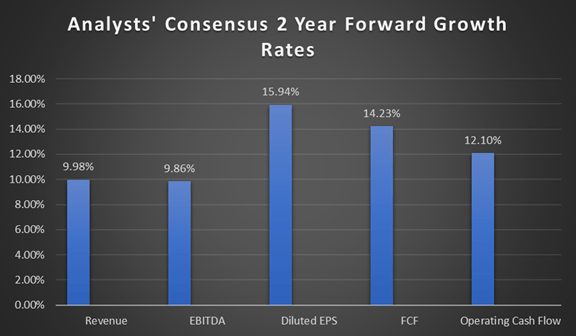

Projected Growth Rates

The next nautical chart provides analysts' consensus ii-year growth rates for a variety of metrics. An example of the manner in which each metric was derived follows.

("The forrard growth rate is a compounded annual growth charge per unit from the most recently completed fiscal year'southward revenue (FY-ane) to analysts' consensus revenue estimates for ii fiscal years forward (FY2).")

Source: Nautical chart by Author

The data has been revised since the final quarterly written report. For example, a month ago, revenue was projected to increase at an annual charge per unit of 8.56% versus the current charge per unit of nine.98%.

Dividend And Valuation

The current yield is .61%. The payout ratio is below xix%, and the five-yr dividend growth charge per unit is approaching 10%. The dividend is safety, and at that place is peachy potential for time to come growth.

As I blazon these words, AAPL shares trade for $135.37. The average 12 month price target of 39 analysts is $133.93. The price target of the fourteen analysts rating the stock since the last quarterly written report is $153.43.

Apple tree's current PE is 36.6, the frontward PE is 28.92, and the PEG is ii.49.

Seeking Alpha'south Factor Grades rates the stock's valuation equally D+. My valuation organisation rates Apple tree stock every bit a B-. I should note that I form on a curve, and so to speak, for rapidly growing companies.

My Perspective

A review of historical data provides no clear cut target for a share cost that would trigger a stock split. Information technology does appear as if the odds of a new stock separate increase as the share price reaches the $200 to $250 range.

At that place is substantial evidence that a stock split does not effect in a surge in share valuation in the thirty days prior to the split; however, on boilerplate, the stock'southward valuation drops roughly v% to 6% in the two weeks following the stock separate.

With minor exceptions, Apple tree is a veritable stock dynamo. Tim Cook and team provide exemplary management. The company has a firm financial foundation and may have a long growth rail in Mainland china.

I rate the stock as a BUY, but with a caveat. My viewpoint is expressed in an excerpt from a prior article devoted to Microsoft (MSFT).

In the past, it has been hard for me to invest in quickly growing companies. My years of investing molded me into an inveterate value investor that seeks a margin of safety. Investing in undervalued companies is a ways to that end. It is reasonable to argue; however, that a durable moat, superior direction, a sound financial foundation and strong prospects for extended growth can too provide investors with a considerable degree of safety. Microsoft undeniably possesses the first three attributes. It is incumbent upon the private investor to measure the degree to which the firm defines the quaternary.

I am calculation to my Microsoft position incrementally. I am using this tactic to mitigate confronting a drop in the shares to a more traditional value while at the same time allowing myself to profit from the increased growth I believe is likely to occur.

1 Last Word

I hope to continue providing manufactures to SA readers. If you found this piece of value, I would greatly appreciate your post-obit me and/or pressing "Like this commodity" just below. This will aid me to proceed to write for SA. All-time of luck in your investing endeavors.

This commodity was written by

The #1 Service for Income Investors and Retirees, +9% dividend yield.

As of 02/21/2022 I am rated among the top ii.one % of authors in terms of overall results. This is according to TipRanks, which provides a 68% success rate and an average 21.4% annual return for my articles. (I update this score on at least a quarterly basis for readers.)

My primary focus is dividend bearing stocks; still, I as well invest in some high growth names to boost my total return.

I am a value / buy and hold investor. Since I require a discount in the share valuations of my investments, my ratings are generally very conservative. My valuation requirements, combined with the high quality companies that I ofttimes highlight, mean many stocks I rate as a hold perform well over the long term. Readers should consider this when weighing my buy/hold/sell recommendations. I seek a degree of safe in my investments by focusing on companies with competitive advantages and reasonable to potent rest sheets.

I am a retail investor, with no formal training in investing.

I am a graduate of the U.South Army Ranger school and a erstwhile fellow member of the 1st Ranger Battalion and The Old Guard (U.Due south Regular army Accolade Guard.) I am a retired law enforcement officer. I accept approximately twenty years experience as a retail investor.

All-time of luck in your investments, Chuck

Disclosure: I am/nosotros are long AAPL. I wrote this article myself, and information technology expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I accept no business relationship with whatever company whose stock is mentioned in this article.

Additional disclosure: I have no formal grooming in investing. All articles are my personal perspective on a given prospective investment and should non exist considered every bit investment advice. Due diligence should be exercised and readers should appoint in additional research and analysis before making their own investment decision. All relevant risks are not covered in this commodity. Readers should consider their own unique investment profile and consider seeking advice from an investment professional before making an investment conclusion.

Source: https://seekingalpha.com/article/4407175-apple-stock-split-may-happen-again-what-to-know

0 Response to "Will Apple Split Their Stock Again"

Post a Comment